Student-Managed Investment Funds provide students with experience managing real investment portfolios. But new research shows only. a small minority of funds include environmental, social and governance (ESG) factors in their mandates. Photo: Shutterstock

By Lorin Busaan, PhD Student, Gustavson School of Business, University of Victoria and Basma Majerbi, Associate Professor of Finance, Gustavson School of Business, University of Victoria via The Conversation • Reposted: September 11, 2023

Sustainable investing takes into account environmental, social and governance (ESG) factors alongside traditional financial components. While this form of investing has existed for a long time, ESG has become a hot-button issue due to recent politicization and widespread public misconceptions around what it really entails.

ESG investing examines quantitative and qualitative non-financial data on companies. This includes environmental issues like carbon emissions, pollution and resource use; social issues like employee treatment and relationships with communities; and governance issues like diversity of corporate boards, business ethics and transparency.

Criticisms of ESG investing have been exacerbated by post-secondary finance programs that barely touch upon these issues, resulting in a significant shortage of qualified sustainable investment professionals.

Due diligence

A basic qualification for finance graduates is the ability to analyze the environmental, social or governance factors that create risks and opportunities for a given company and, in turn, affect investors’ returns.

Unfortunately, graduates often lack even this basic qualification, in addition to more advanced expertise required to assess the investment impacts on people and the planet.

Given the climate crisis and persistent inequality, business schools must urgently and immediately tackle the sustainability deficit in finance education. Formal instruction must be enhanced with experiential learning techniques that expose students to the complexity and nuances of sustainable investing.

Our research shows that Student Managed Investment Funds (SMIFs) — currently present at many Canadian universities — are an underused, hands-on learning opportunity for training the next generation of sustainable investment professionals.

ESG under fire

Despite the potential of sustainable investing to accelerate the net-zero carbon transition and support the UN Sustainable Development Goals (SDGs), it has come under fire in recent years.

Politically, sustainable investing has become a flashpoint for partisan conflict in America’s culture wars. Right-wing critics argue that including ESG considerations in investment decisions is intrusive moralizing and part of a “woke capitalism” agenda.

Counterparts on the left downplay concerns about economic transition costs or exaggerate the power of ESG investing to create a better world.

Recent studies also show that third-party ESG ratings are unreliable, leaving considerable room for greenwashing or, at minimum, “greenwishing” — when companies or investors have good intentions but fail to meet their sustainability goals.

Criticisms and politicization, combined with other factors, have curtailed flows to ESG funds. This is unfortunate given the urgent need to mobilize more financial capital to address climate change, biodiversity loss and inequality.

Reforming business schools

Developing competence in sustainable investing requires a serious revision in business school finance programs.

Core courses must include sustainable investing concepts and tools as part of mainstream financial education. This is especially important given fast-evolving ESG and climate-related regulations and rising global risks that pose new threats to companies and investors.

It’s also important that students learn the limits of different forms of sustainable investing to avoid falling into the trap of greenwashing.

Many ESG strategies primarily focus on risk mitigation with, at best, a marginal impact on people or the planet. Others, such as impact investing, focus on measurable social and environmental outcomes, often using the UN’s SDGs for their impact goals, alongside financial returns.

Impact investing could unlock much needed capital for critical sectors in the net-zero transition that would otherwise be underfunded when using traditional financial metrics.

In short, sustainable investing, in all its forms, requires additional skills that are currently lacking in finance education. Social and environmental impacts can be difficult to quantify and may require longer-term perspectives and qualitative judgements about potential impacts on many stakeholders.

Student-managed investment funds

These skills are best developed through hands-on practice that supplements formal instruction. Student-Managed Investment Funds (SMIFs) provide students with experience working together to manage real investment portfolios under the guidance of faculty supervisors and industry professionals.

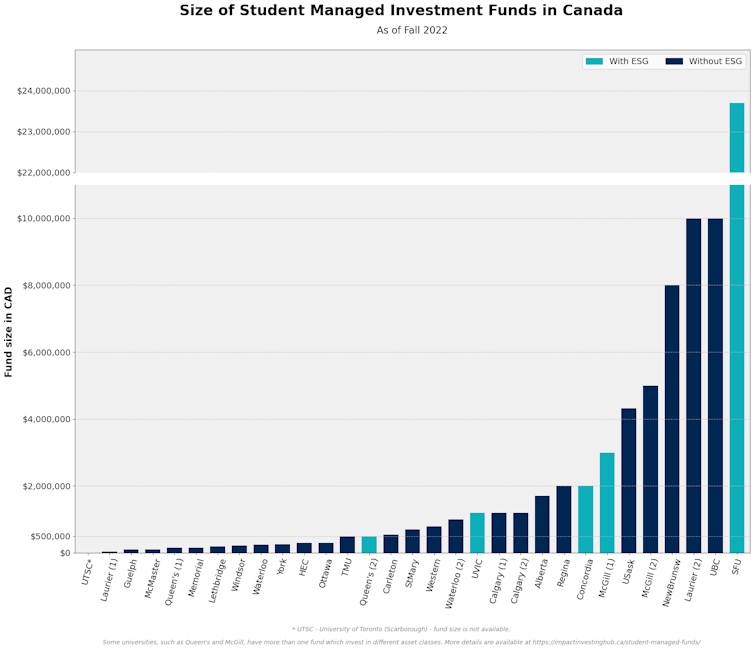

Canadian universities have established more than 30 funds that students oversee as portfolio managers, buying and selling stocks, bonds or other assets. The capital in these funds comes from a variety of sources, including donations from companies, philanthropic gifts from individuals or foundations, and in some cases from university endowments.

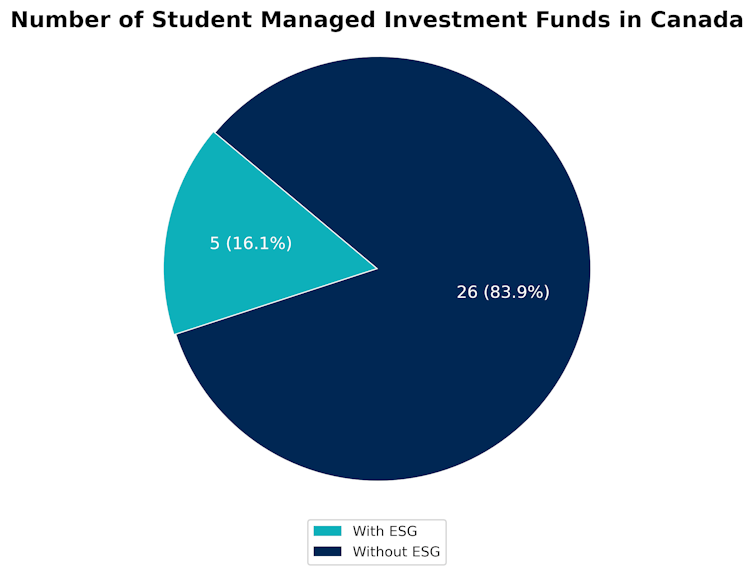

Unfortunately, our research shows that only a small minority of these funds include ESG considerations in their mandates.

Of the 31 Canadian SMIFs we analyzed (totalling $79.5 million managed by students), only five (16 per cent) have some level of ESG consideration. Since business schools have long used student-managed funds to train the next generation of investment bankers, financial analysts and other financial industry professionals, this is surprising — and disappointing.

The gap is even more pronounced for impact investing, which is barely mentioned in any of the funds in our sample, despite universities’ commitments to the UN’s Sustainable Development Goals.

Sustainable finance education could benefit greatly when students work together to integrate financial, environmental and social factors in student-managed investment funds.

Learning by doing helps students develop important analytical skills, familiarizes them with key tools and data sources and helps them navigate the maze of ESG standards, frameworks and guidelines.

The role of universities

Including sustainability mandates in finance programs and student-managed investment funds will ensure Canadian universities train the next generation of sustainable investment professionals needed to accelerate the net-zero transition.

We encourage university administrators and finance educators across the country to immediately implement ESG policies for existing student-managed investment funds. In collaboration with industry and donors, new funds could also be established that focus on particular themes, like climate solutions or nature-positive investing.

One encouraging initiative in this regard is by Propel Impact, a non-profit that is collaborating with seven universities to run their own local student impact funds.

Through creative partnerships with investors, Propel has been supporting student training while benefiting local communities, with $750,000 directed by students toward 14 Canadian social enterprises over the past three years. We offer this program to University of Victoria students and hope it expands to more Canadian universities.

As we confront pressing social and environmental challenges, we can’t be discouraged by partisan sniping. Instead, we must build momentum for sustainable investing by training future financial professionals more effectively.

To see the original post, follow this link: https://theconversation.com/business-schools-must-step-up-on-sustainable-investing-education-208352

You must be logged in to post a comment.