Image credit: blacksalmon/Adobe Stock

By Carol Cone from Triple Pundit • Reposted: September 13, 2023

The term ESG is fine, according to a recent poll of 1,000 Americans. Despite continued polarization related to the acronym, which stands for environmental, social and governance, the majority of Americans believe it’s the best way to describe a company’s approach to improve business, society and the environment. Before we get to the data, though, it’s important to understand why we asked this question in the first place.

How did we get here?

Over the past year, a rising chorus of conservative U.S. voices have claimed that ESG is “woke capitalism,” or corporate virtue signaling about social and environmental concerns which they see as beyond the bounds of business.

The issue drew President Joe Biden’s first presidential veto in March of this year, defending legislation related to ESG investing and bringing the issue into the national spotlight. ESG is facing such a significant backlash that BlackRock CEO Larry Fink, long one of the financial industry’s staunchest proponents for purpose and ESG, doesn’t even want to use the term — though BlackRock’s policies around society, the environment, and business governance remain unchanged.

It’s also important to establish that whatever you call them, sound ESG practices are not new, and are indeed vital to operating a responsible, ethical, and profitable business. As Fortune sustainability reporter Eamon Barrett observed, “major corporations documenting their environmental, social, and governance policies for investor scrutiny is actually a decades-old process.” At its core, ESG is a means to broaden the lens on what constitutes key drivers of business value, accompanied by efforts to measure and report on what matters for individual company operations via standardized reporting frameworks.

Americans say ESG is a-okay

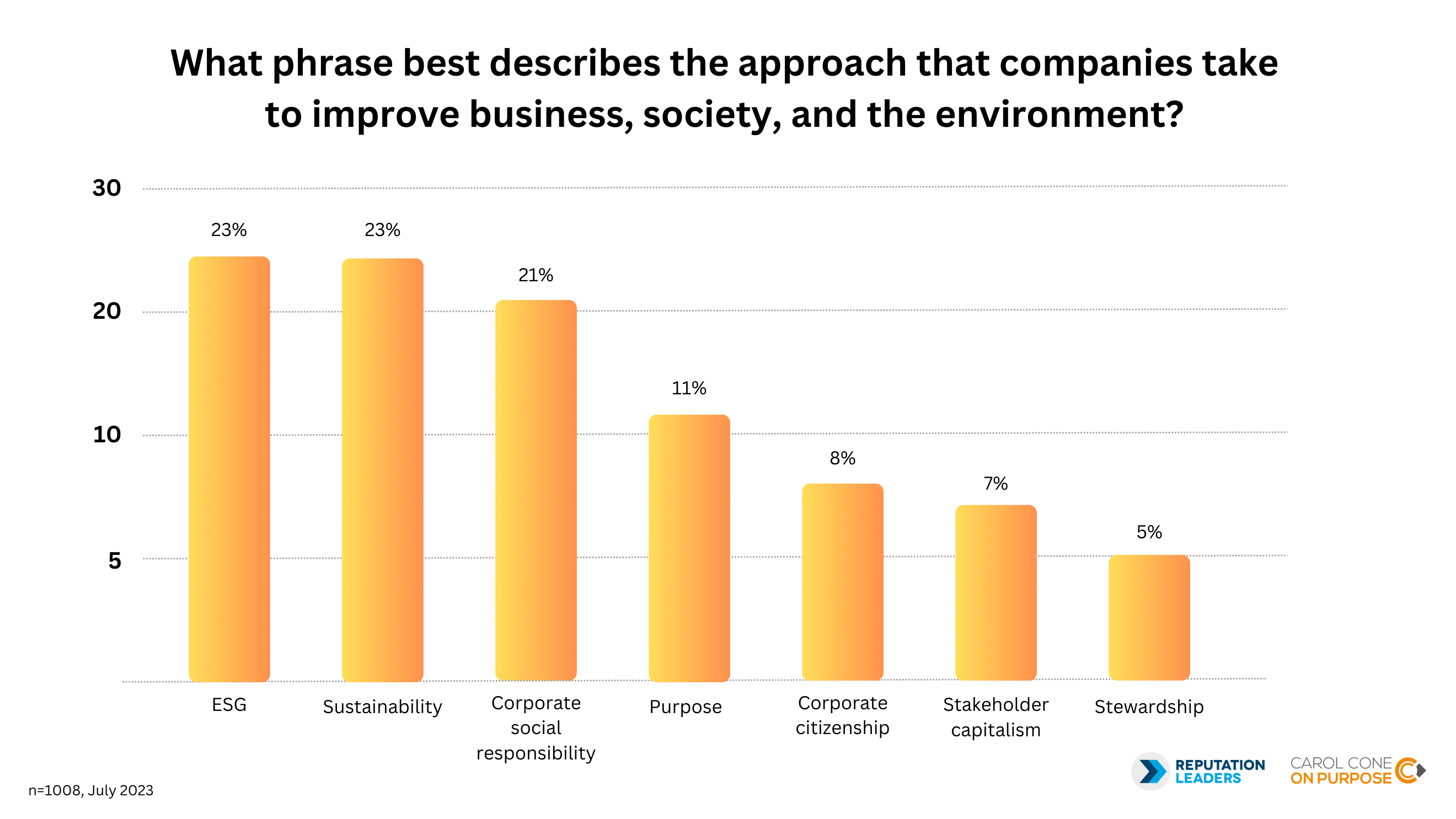

We partnered with Purpose Collaborative member Reputation Leaders, a global research and thought leadership consultancy, to ask Americans what term they feel best describes “the approach companies take to improve business, society and the environment.”

ESG and sustainability are tied for the top, at 23 percent each. Corporate social responsibility is second, at 21 percent, followed by purpose (11 percent), corporate citizenship (8 percent), stakeholder capitalism (7 percent) and stewardship (5 percent).

Across demographic groups, ESG and sustainability are the favored terms among men, while women prefer “corporate social responsibility,” a phrase that connotes a sense of obligation. ESG is also the top choice for younger audiences, particularly those aged 25 to 34, while consumers aged 55 to 64, prefer the term “sustainability.” There are regional differences, as well. People living in the Northeast prefer sustainability, while their Southern and Midwestern counterparts prefer ESG.

Reputation Leaders also analyzed the tone of media coverage related to Americans’ top three terms: ESG, CSR and sustainability. CSR garnered the largest share of positive sentiment at 37 percent, with sustainability in second place at 32 percent and ESG trailing at 20 percent. ESG was the only term to have a significant amount (10 percent) of negative sentiment.

What now?

This study can help support companies in exploring the terms they will use to discuss the impact their business has on society. It is important to develop a clear, shared perspective and take a long-term view.

From the United Nations to the World Economic Forum, global leaders are advocating for businesses to embed a net-positive approach into their operating models to accelerate innovation and impact. Increasingly, employees, customers, supply chain partners, and others are asking about the ESG commitments of the companies they work for or with. Business leaders need to have answers and a strong point of view on which issues are most important to their business, and why. Our best advice? Don’t worry about what you call it — stick to your organization’s long-term, strategic commitments to stakeholders, society and the environment.

When it comes to communications, here are three ways to help depolarize the conversation:

- Be clear about the goals of ESG. ESG is not about imposing a set of values on business. It provides a framework for companies to assess and optimize their value and impact.

- Increase transparency around ESG data and metrics. This will help to ensure that investors and other stakeholders are making informed decisions.

- Embrace standardized reporting frameworks. This will make it easier to comparecompanies’ ESG performance — think: the Task Force on Climate-Related Financial Disclosures (TCFD), the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB).

Yes, the polarization will continue, especially as the 2024 presidential election nears. As the world continues to endure climate impacts from extreme heat and flooding to record-breaking wildfires, there also will be greater demand for businesses to address environmental challenges.

Scores of studies suggest that ESG — done right — drives sustainable competitive advantage and can accelerate organizational growth over the long-term. An impressive 80 percent of investors believe that companies with strong ESG practices can generate higher returns and make for better long-term investments, according to research from Morgan Stanley.

By continuing to show a link between ESG issues and the business, we can help to make the debate around ESG more constructive and less polarizing. This will ultimately benefit businesses, investors and society as a whole.

To see the original post, follow this link: https://www.triplepundit.com/story/2023/americans-think-esg/783186

You must be logged in to post a comment.