Climate Week attendees strike a pose at the SDG Pavilion in front of the United Nations Headquarters in New York City on September 21, 2023. (Image credit: U.N. Partnerships/Pier Paolo Cito via Flickr)

By Mary Riddle from Triple Pundit • Reposted: October 9, 2023

As the Sustainable Development Goals (SDGs) reach their midpoint, the world is “woefully off-track” in meeting the targets by the 2030 deadline, the United Nations warned this summer. Only 15 percent of the SGDs are on track, according to the U.N. Global Compact. Progress on 37 percent of the targets has either stagnated or reversed, while efforts on the remaining half are considered weak or insufficient. With seven years left to meet the Global Goals, the U.N. is calling on the private sector to help accelerate implementation.

While business leaders remain confident about the vision for the future underscored in the SDGs, their confidence in meeting the targets by 2030 dwindled from 92 percent in 2022 to 51 percent this year, according to a new report.

Last month, Accenture partnered with the U.N. Global Compact to publish the Global Private-Sector Stocktake, a first-of-its-kind look at private-sector impact on the SDGs, with tangible action items and resources that companies can consider to drive progress on the road to 2030. The report outlined 10 key pathways for corporations — which include putting existing markets to work for social equity by way of a living wage and addressing gender pay gaps, as well as more transformative moves to integrate the SDGs into corporate finance and promote sustainability leadership in the private sector.

Sustainable corporate finance

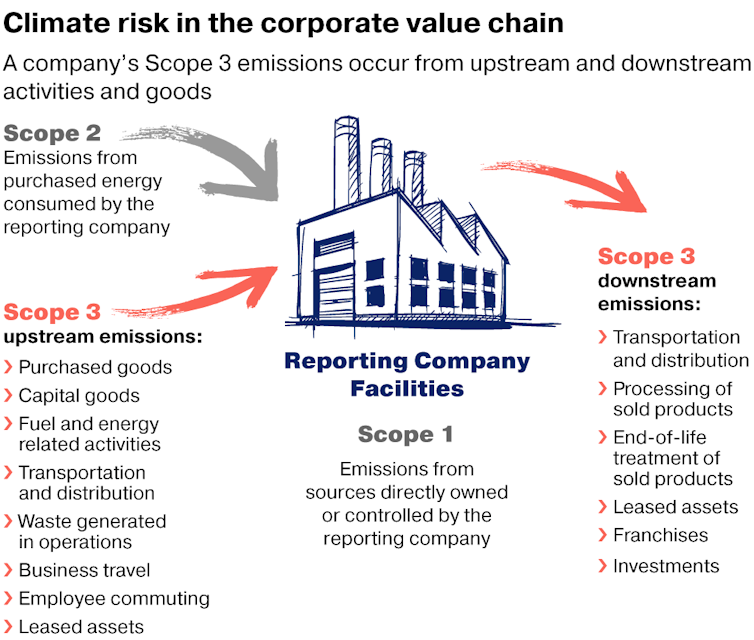

“There is a lot of momentum around impact accounting, which ensures companies are taking into full account both tangible outcomes like revenues and returns for shareholders, but also the intangible outcomes like indirect carbon emissions,” said Vik Viniak, senior managing director and North America sustainability lead at Accenture.

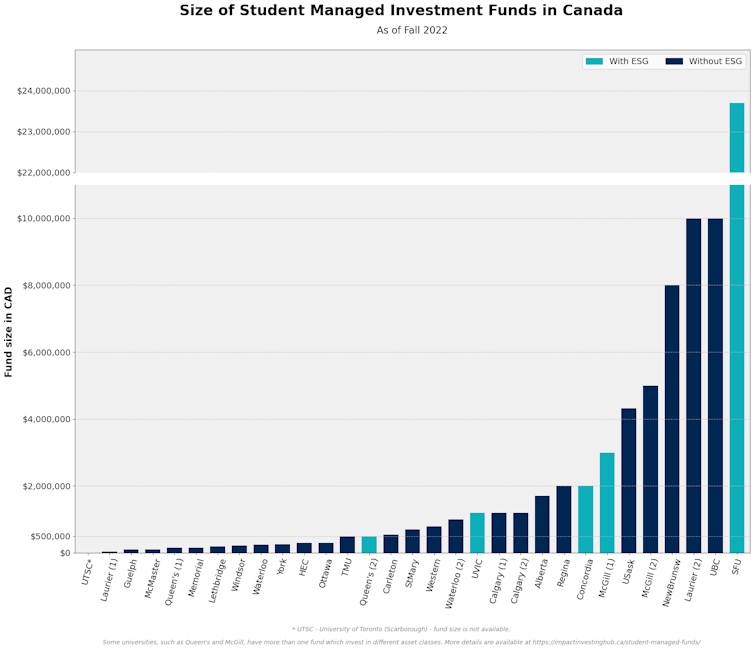

“For example, Mastercard links incentives for executives and employees to their ESG [environmental, social and governance] objectives, which include gender equity and emissions reductions,” he said. “With Google and Amazon, if you look at their tech businesses like Google Cloud and [Amazon Web Services], they are using green principles to create more energy-efficient computing systems, and that ties into their executive remuneration. In most public companies, your compensation is tied to shareholder value, but it is important to remember that ESG is also directly tied to shareholder value.”

Sustainable corporate finance just makes good business sense. Impact accounting helps corporations establish better decision-making frameworks and can give companies leverage in discussions with their supply chain partners.

“If you are looking at two suppliers in your supply chain and everything else is equal, but one supplier has a better record on emissions, suddenly the decision becomes much easier,” Viniak said. Impact accounting should also be part of a company’s public reports, he said.

However, he emphasized that sustainable finance is an evolving space. The U.N. Global Compact launched the CFO Coalition last month to put clear definitions and guidelines in place to help companies integrate the SDGs into their corporate financing. Viniak is optimistic about the coalition’s work. “The current state of confusion is causing companies to not take action,” he said. “There is a paralysis. This clarity can help get blood flowing so it can function.”

Strengthening sustainability leadership for the SDGs

“True sustainability leadership is about holding senior leaders accountable,” Viniak said. “Empower everyone in the organization to take action, but make sure leaders are talking the talk and walking the walk. We need humility and self-realization in organizations. Management can lead by being humble and knowing that they can do more.”

There are clear benefits to corporate support for the SDGs, but it is important for companies to be able to substantiate their claims, show their metrics, and transparently report on their goals, reasoning and progress. “The market has gotten smarter,” Viniak said. “Investors and consumers can identify SDG-washing in companies that can’t support their claims.”

When leaders embrace the SDGs, it can serve to engage the entire workforce, Viniak said. “For leaders, one of the most important incentives for working toward the SDGs is that people are going to get excited,” he told us. “At Accenture, we have a huge, young workforce, and this workforce is asking Accenture what we are doing for the SDGs. Our CEO always says that we need to be our best credential. We have rallied our workforce around the mission of sustainability, and in our global workforce, in every community we are in, our people are making an impact. You can rally your whole organization around the SDGs and give them the tools to measure their impacts, and we can all hold each other accountable.”

The SDG Stocktake is a clarion call for all corporations

For companies that have yet to examine their impact on the SDGs, Viniak emphasized that it is not too late. “I encourage every company to start the process of understanding specific ESG impacts based on their industry and sector,” he said. “The biggest positive and negative impacts need to inform strategy.”

Once a corporation clearly understands their ESG impacts, they can evaluate how those impacts could help meet the targets of the SDGs and embed that into their decision-making frameworks.

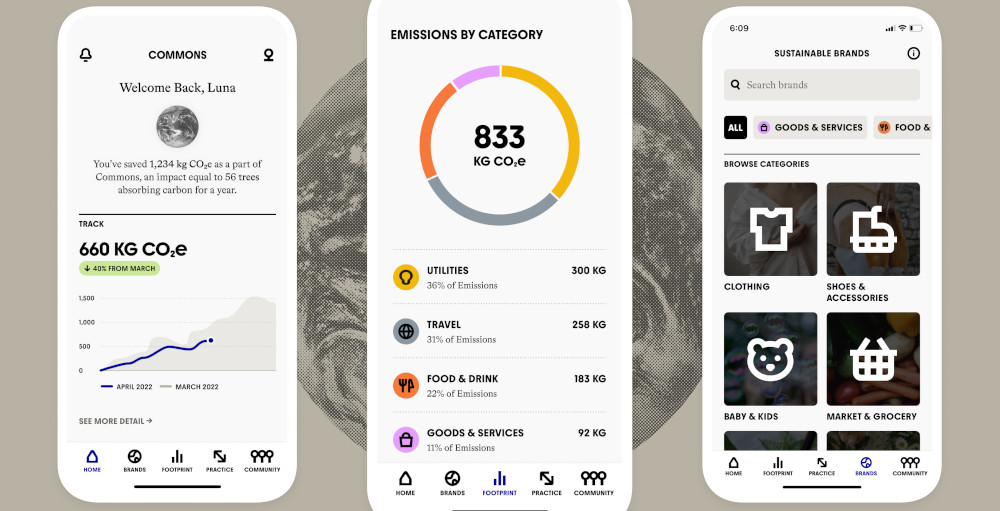

“You can’t improve what you can’t measure,” Viniak said. “Companies must reflect on their impact on the SDGs. Then, they must set goals, identify how they can continue to accelerate the areas in which they lead, and how they can double down to improve those areas where they might be behind.”

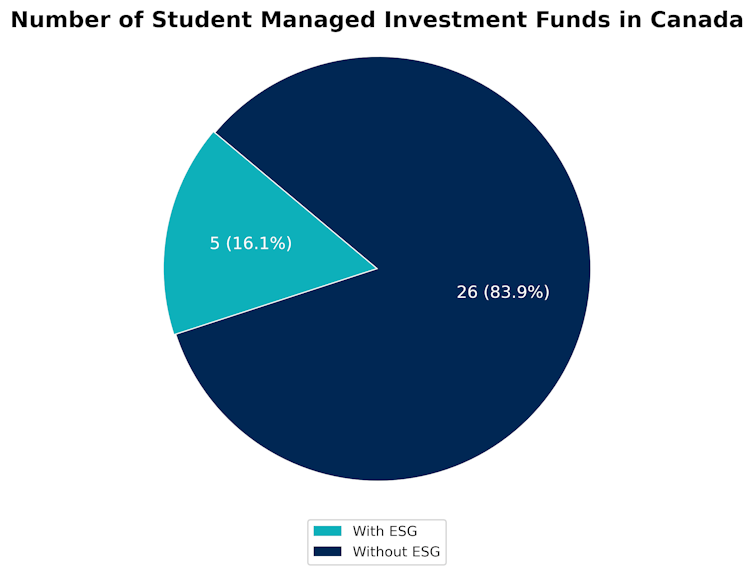

Scaling up new incentive systems is also key to move progress forward. In the Global Private-Sector Stocktake report, business leaders clearly identified the support they need. “There is a huge lack of clarity in terms of goals and measurements,” Viniak explained. “Eighty percent of business leaders claim there are insufficient policy incentives to incorporate ESG considerations, and 84 percent are uncertain about measurements and calculations.”

Fortunately, the private sector is rapidly innovating to address leadership concerns, with new data management companies and softwares regularly coming to market that address these challenges. “There are now data providers that are helping companies define specific impacts on the SDGs,” Viniak said. “This kind of data could help companies understand their own impact in a measurable way for the first time.”

But for these services to make a difference, companies have to use them. “Companies need to see the value of this and pay for it,” Viniak said. “This data could revolutionize incentives if tied to accounting and taxation in the future. We may be able to crack the data measurement problem soon. While companies are currently not being held accountable in consistent ways, with emerging data tools, they can be and should be.”

Viniak recognizes that the private sector is off track, but he remains optimistic. “Games are won in the second half, not the first,” he said. “Yes, we are trailing. We are behind, but we can win. The private sector is a key player to achieve the SDGs. It is time to step up in the second half to win this game.”

To see the original post, follow this link: https://www.triplepundit.com/story/2023/ways-business-support-sdgs/785016

Image credit:

Image credit:

You must be logged in to post a comment.