Legos are designed to last for decades. That posed a challenge when the toymaker tried to switch to recycled plastics. AP Photo/Shizuo Kambayashi

By Tinglong Dai, Professor of Operations Management & Business Analytics, Carey Business School, Johns Hopkins University, Christopher S. Tang, Professor of Supply Chain Management, University of California, Los Angeles and Hau L. Lee, Professor of Operations, Information & Technology, Stanford University via The Conversation • Reposted: October 7, 2023

Lego, the world’s largest toy manufacturer, has built a reputation not only for the durability of its bricks, designed to last for decades, but also for its substantial investment in sustainability. The company has pledged US$1.4 billion to reduce carbon emissions by 2025, despite netting annual profits of just over $2 billion in 2022.

This commitment isn’t just for show. Lego sees its core customers as children and their parents, and sustainability is fundamentally about ensuring that future generations inherit a planet as hospitable as the one we enjoy today.

So it was surprising when the Financial Times reported on Sept. 25, 2023, that Lego had pulled out of its widely publicized “Bottles to Bricks” initiative.

This ambitious project aimed to replace traditional Lego plastic with a new material made from recycled plastic bottles. However, when Lego assessed the project’s environmental impact throughout its supply chain, it found that producing bricks with the recycled plastic would require extra materials and energy to make them durable enough. Because this conversion process would result in higher carbon emissions, the company decided to stick with its current fossil fuel-based materials while continuing to search for more sustainable alternatives.

As experts in global supply chains and sustainability, we believe Lego’s pivot is the beginning of a larger trend toward developing sustainable solutions for entire supply chains in a circular economy. New regulations in the European Union – and expected in California – are about to speed things up.

Examining all the emissions, cradle to grave

Business leaders are increasingly integrating environmental, social and governance factors, commonly known as ESG, into their operational and strategic frameworks. But the pursuit of sustainability requires attention to the entire life cycle of a product, from its materials and manufacturing processes to its use and ultimate disposal.

The results can lead to counterintuitive outcomes, as Lego discovered.

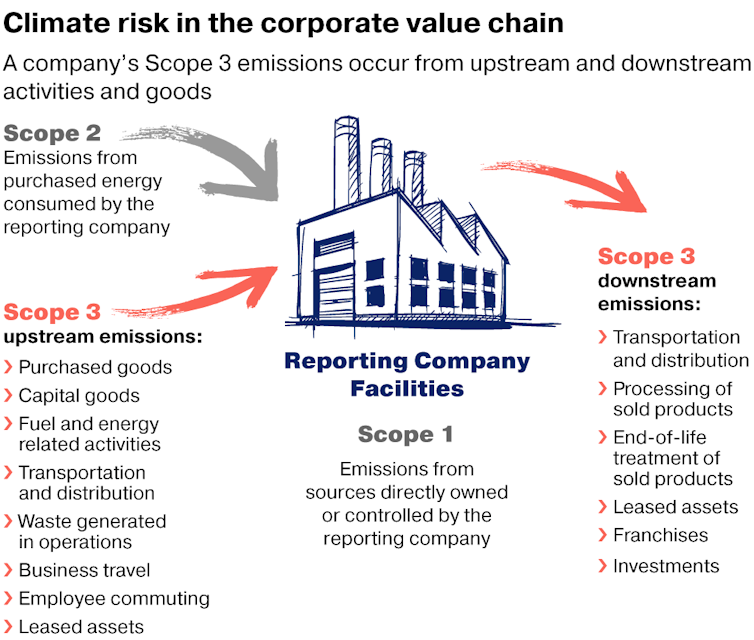

Understanding a company’s entire carbon footprint requires looking at three types of emissions: Scope 1 emissions are generated directly by a company’s internal operations. Scope 2 emissions are caused by generating the electricity, steam, heat or cooling a company consumes. And scope 3 emissions are generated by a company’s supply chain, from upstream suppliers to downstream distributors and end customers.

Currently, fewer than 30% of companies report meaningful scope 3 emissions, in part because these emissions are difficult to track. Yet, companies’ scope 3 emissions are on average 11.4 times greater than their scope 1 emissions, data from corporate disclosures reported to the nonprofit CDP show.

Lego is a case study of this lopsided distribution and the importance of tracking scope 3 emissions. A staggering 98% of Lego’s carbon emissions are categorized as scope 3.

From 2020 to 2021, the company’s total emissions increased by 30%, amid surging demand for Lego sets during the COVID-19 lockdowns – even though the company’s scope 2 emissions related to purchased energy such as electricity decreased by 40%. The increase was almost entirely in its scope 3 emissions.

As more companies follow in Lego’s footsteps and begin reporting scope 3 emissions, they will likely find themselves in the same position, realizing that efforts to reduce carbon emissions often boil down to supply chain and consumer-use emissions. And the results may force them to make some tough choices.

Policy and disclosure: The next frontier

New regulations in the European Union and pending in California are designed to increase corporate emissions transparency by including supply chain emissions.

The EU in June 2023 adopted the first set of European Sustainability Reporting Standards, which will require publicly traded companies in the EU to disclose their scope 3 emissions, starting in their reports for fiscal year 2024.

California’s legislature passed similar legislation requiring companies with revenues of more than $1 billion to disclose their scope 3 emissions. California’s governor has until Oct. 14, 2023, to consider the bill and is expected to sign it.

At the federal level, the U.S. Securities and Exchange Commission released a proposal in March 2022 that, if finalized, would require all public companies to report climate-related risk and emissions data, including scope 3 emissions. After receiving significant pushback, the SEC began reconsidering the scope 3 reporting rule. But SEC Chairman Gary Gensler suggested during a congressional hearing in late September 2023 that California’s move could influence federal regulators’ decision.

This increased focus on disclosure of scope 3 emissions will undoubtedly increase pressure on companies.

Because scope 3 emissions are significant, yet often not measured or reported, consumers are rightly concerned that companies that claim to have low emissions may be greenwashing without taking action to reduce emissions in their supply chains to combat climate change.

At the same time, we suspect that as more investors support sustainable investing, they may prefer to invest in companies that are transparent in disclosing all areas of emissions. Ultimately, we believe consumers, investors and governments will demand more than lip service from companies. Instead, they’ll expect companies to take actionable steps to reduce the most significant part of a company’s carbon footprint – scope 3 emissions.

A journey, not a destination

The Lego example serves as a cautionary tale in the complex ESG landscape for which most companies are not well prepared. As more companies come under scrutiny for their entire carbon footprint, we may see more instances where well-intentioned sustainability efforts run into uncomfortable truths.

This calls for a nuanced understanding of sustainability, not as a checklist of good deeds, but as a complex, ongoing process that requires vigilance, transparency and, above all, a commitment to the benefit of future generations.

To see the original post, follow this link: https://theconversation.com/legos-esg-dilemma-why-an-abandoned-plan-to-use-recycled-plastic-bottles-is-a-wake-up-call-for-supply-chain-sustainability-214573

You must be logged in to post a comment.