(Image credit: .shock/Adobe Stock)

By Mary Mazzoni from Triple Pundit • Reposted: February 29, 2024

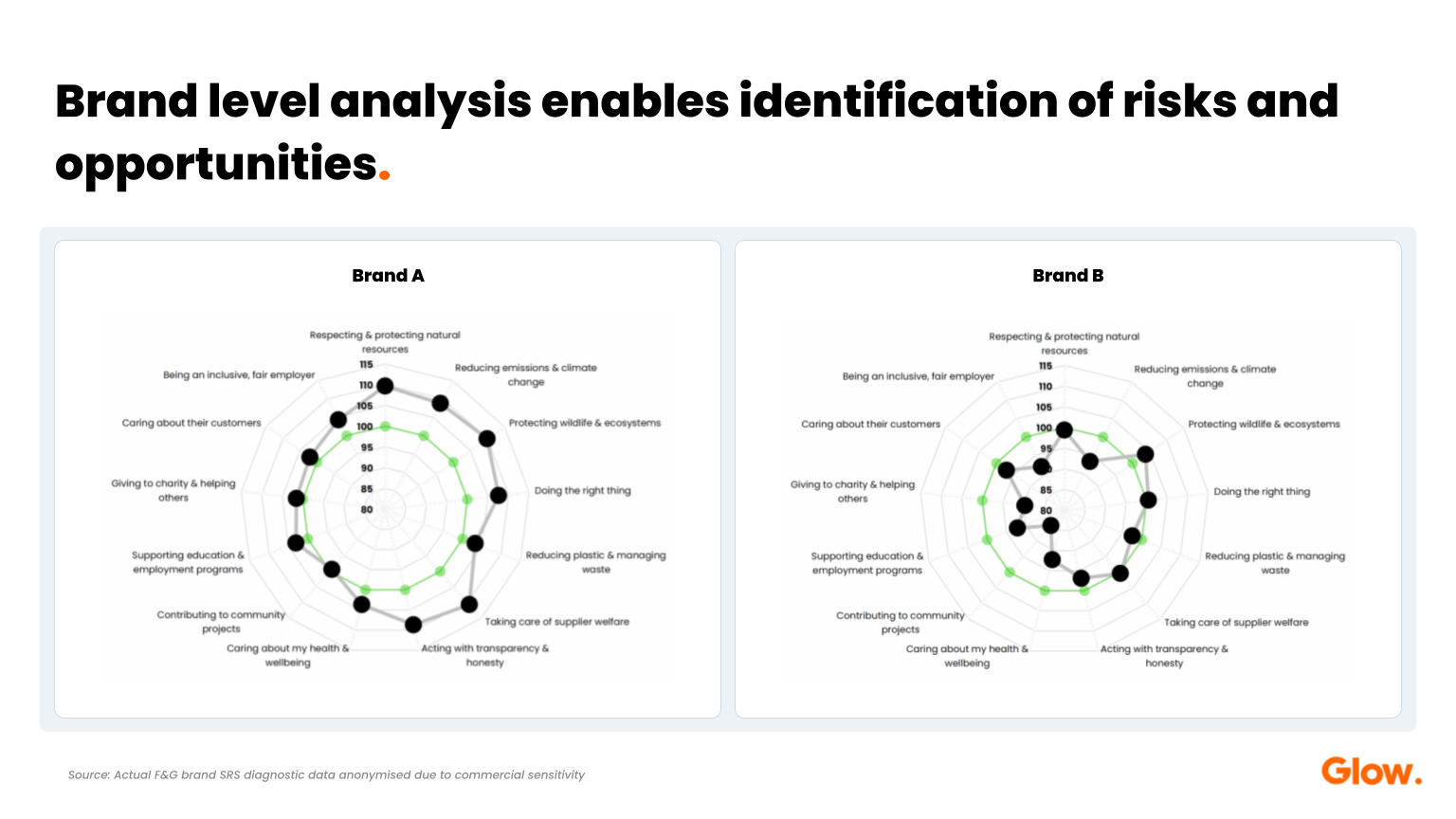

We often hear that consumers are looking for sustainable products and brands, and that many are even willing to pay more for them. But it’s often difficult for brand leaders to pin down just how much of an impact sustainability really has on consumer purchasing, making it harder to tie investments in sustainability to the bottom line. A new piece of research out this week puts a dollar figure on consumer affinity for sustainable brands for the first time — and it’s big enough to make leaders take notice.

A $44 billion prize is up for grabs as consumers switch from brands they perceive as less sustainable to brands they perceive as more sustainable, according to the analysis from the research technology firm Glow, in partnership with TriplePundit, our parent company 3BL and panel partner Cint.

“We wanted to really understand: If it’s important, can we see it in the data? Can we show a link between business performance and the investment in sustainability from a consumer perspective?” Glow CEO Tim Clover said during an on-demand webcast we hosted about the research. “The key point here is that the opportunity is quantifiable.”

Consumers are voting with their wallets, and now we know how much that’s worth for sustainable brands

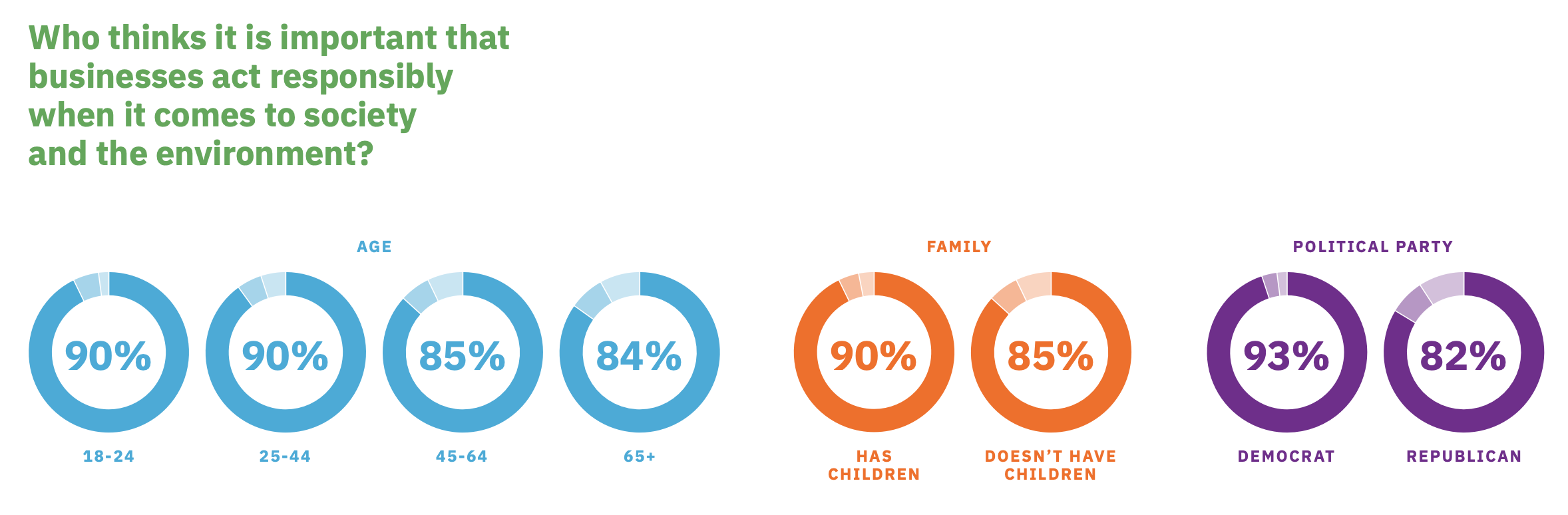

The notion that businesses acting responsibly is somehow controversial has crept into the fringes of the U.S. cultural zeitgeist over the past few years. But there’s little evidence the public is on board, and our research is the latest to prove this out.

More than 85 percent of U.S. consumers consider it important for businesses to act responsibly with regards to society and the environment, compared to only 3 percent who don’t, according to our survey of more than 3,000 U.S. adults conducted in November 2023.

“In this study we show, as has been shown previously, that this issue is almost universally important to consumers,” Mike Johnston, data product leader at Glow, said during our webcast interview. “We also show there’s an expectation for businesses to act on these issues.”

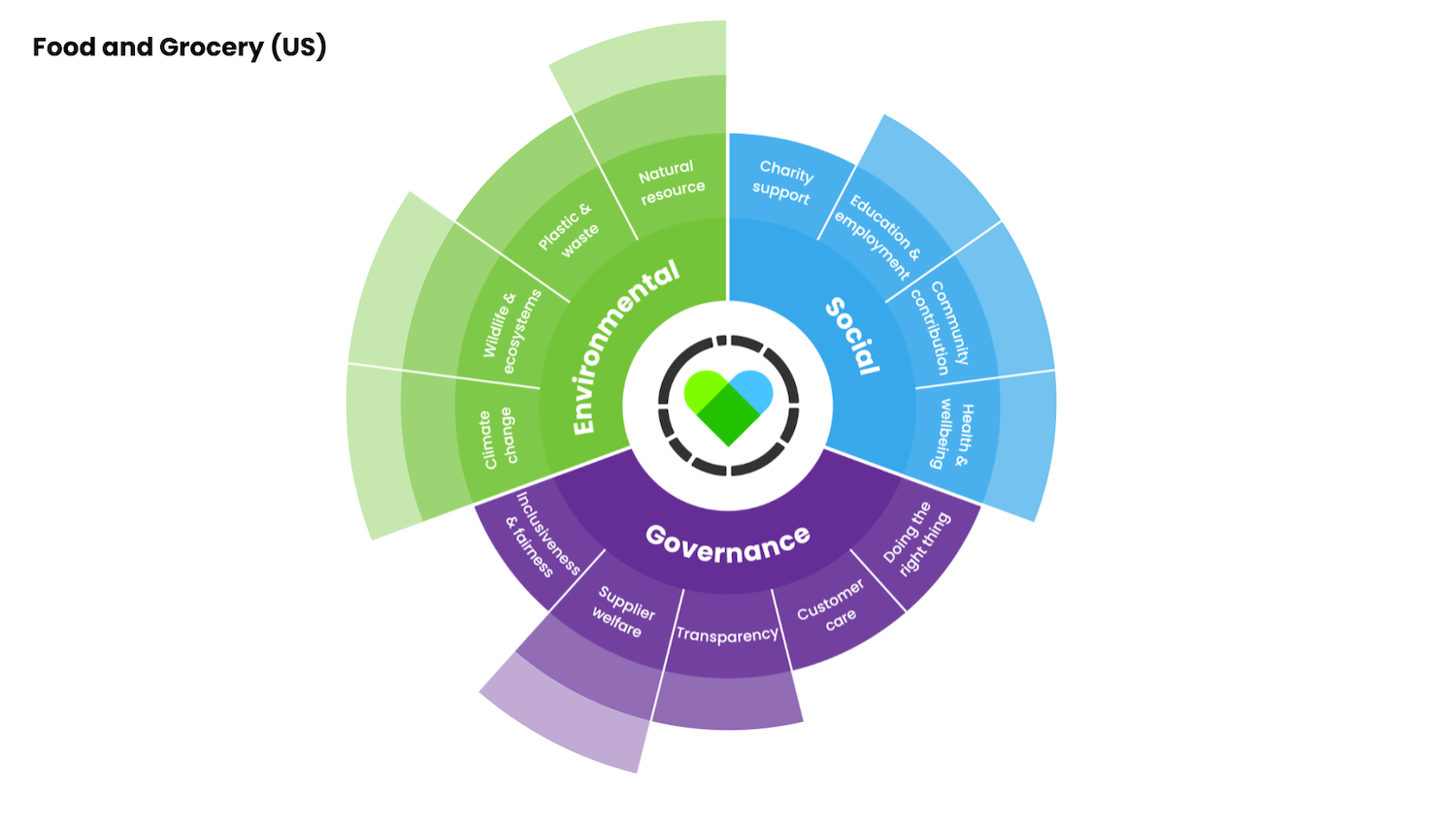

That expectation increasingly translates into how people spend their money. As part of the report, we asked consumers about the level of influence sustainability has on their choice of products and brands across 12 industries. About a quarter of respondents said they stopped doing business with a brand in 2023 because of its social or environmental behavior.

The rate of sustainability-driven brand switching is even higher in some sectors. In the food and grocery sector, 33 percent of consumers said they switched from one brand to another because of sustainability last year, while 31 percent said the same about pension fund providers and airlines.

“In a sector like food and grocery, this might be expected,” observed TriplePundit contributor Andrew Kaminsky, lead author of the report. “Think about how often consumers make food and grocery purchases, and how easy it is to try a different product. Pension funds, on the other hand, are much less transitory, and consumers need to go through considerable efforts to make sustainable changes.”

Still, 22 percent of consumers say social and environmental issues are “the single most important factor” in choosing a pension fund provider, according to the report. A finding like this is significant “not just for pension fund managers, but for all companies nationwide,” Kaminsky noted. “As pension funds invest in a wide range of companies across sectors, the high priority placed on sustainability means that companies that want to attract investors will have to improve their sustainability credentials.”

Brand switching and preference for sustainable brands is only increasing

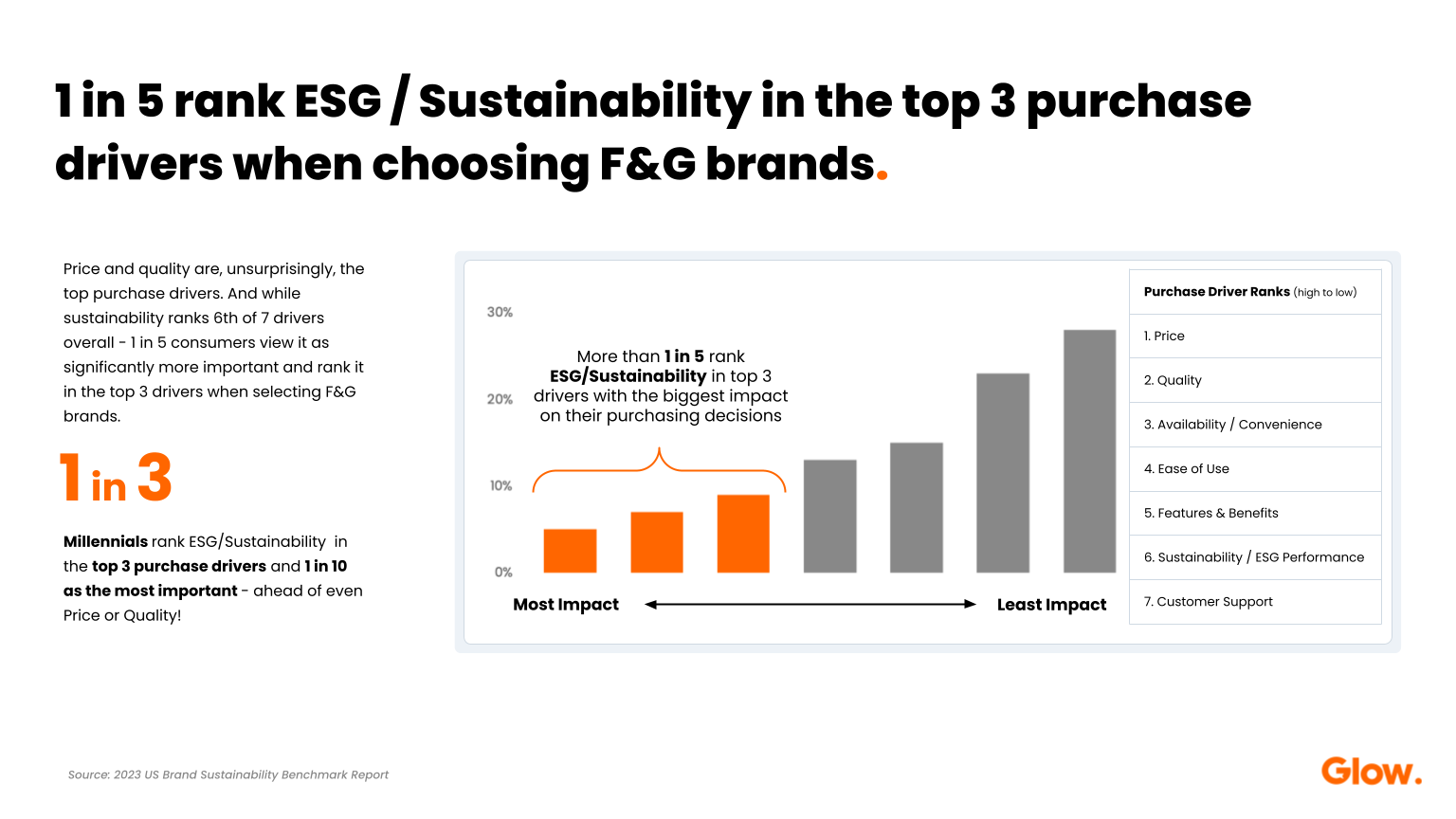

Even as the rising cost of living reaches crisis proportions across the U.S., people are still interested in sustainable brands and products. Of course price is an important factor for consumers, but it’s far from the only thing they’re looking for in a company they patronize — and most told us that sustainability will only play a bigger role in their buying patterns over time.

More than half (58 percent) of consumers say social and environmental considerations are more influential today than they were a year ago, and half expect this influence to continue growing in 2024.

“We hear a lot of talk about, ‘People say sustainability is important, but they won’t act.’ Well, that’s not what the data says,” Clover told us. “What it says is that there are cohorts of people in the population who are very well-educated around key issues for particular categories and industries, and that they will often act. And that cohort of people is growing.”

The fact that sustainability plays such an important role alongside other purchase drivers like price and product quality — enough to put it in a top-three rank or higher for many industries we analyzed — may be surprising to some. But Johnston cautions brand leaders to pay close attention to findings like these and not fall into the trap of prioritizing price above all else.

“This kind of report does two things. One, it really gives the rationale and the economic viability to act now because there is payoff, but it also shows that there’s a future imperative,” Johnston said. “As cost of living starts to reduce for certain cohorts of the population — and it will — those that have ignored sustainability while it’s been growing in importance in the background will be playing catch-up. And you don’t want to be in that position with something that is going to continue to be of increasing importance to how customers make their decisions.”

The communication opportunity for sustainable brands

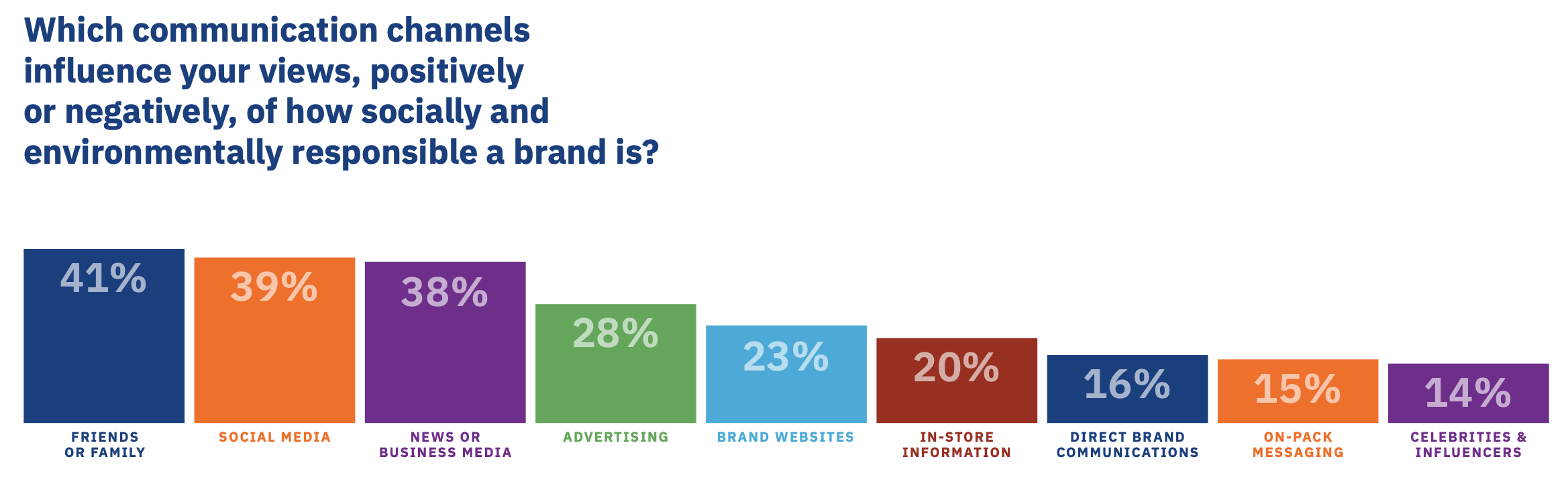

Consumers have to know what sustainable brands are doing in order to reward them for it. Our research shows many are actively seeking more information about what brands do when it comes to society and the environment, presenting a golden opportunity for sustainable brands to reach consumers with effective messaging and score new sales.

“If we don’t communicate, we can’t educate people about where we are and why we’re investing and taking the pathway we’re taking,” Clover said.

Around a quarter of consumers said the reason sustainability didn’t factor more into their purchase decisions is because they “don’t know enough” about brands’ sustainability credentials to make an informed purchase.

“Price and lack of information are the leading reasons why consumers don’t consider sustainability more in their purchases,” Kaminsky noted in the report. “While the need to pay more for products that are responsibly managed might be unavoidable, lack of information is certainly within a brand’s control.”

The report explores in detail how to best reach various audiences with effective messaging on the platforms where they gather to learn more about sustainability, but the top-line message is: A growing segment of people want to learn more, and if brands don’t tell their own sustainability stories in a way that reaches and resonates with these consumers, others will tell that story for them.

“There are ways to discuss sustainability in an accurate and informative way, without falling prey to ‘greenhushing’ or retreating to the sidelines,” Kaminsky wrote in the report. “It’s fairly straightforward, but it’s something that brands and their marketing teams struggle to do effectively.”

The type of messaging that stands out is keenly focused on the issues consumers care about, backed up by evidence and, ideally, confirmed by third parties like media partners, researchers and influencers who consumers look to and trust.

Mary Mazzoni has reported on sustainability and social impact for over a decade and now serves as executive editor of TriplePundit. To see the original post, follow this link: https://www.triplepundit.com/story/2024/sustainable-brands-consumer-purchasing/795941

You must be logged in to post a comment.