Photo: CNBC/Getty Images

Google Cloud & Harris Poll shared that 59% of executives overstate how they approach sustainable messaging. Here’s how companies can improve their efforts. By Lucy Buchholz from Sustainability Magazine • Reposted: May 29, 2023

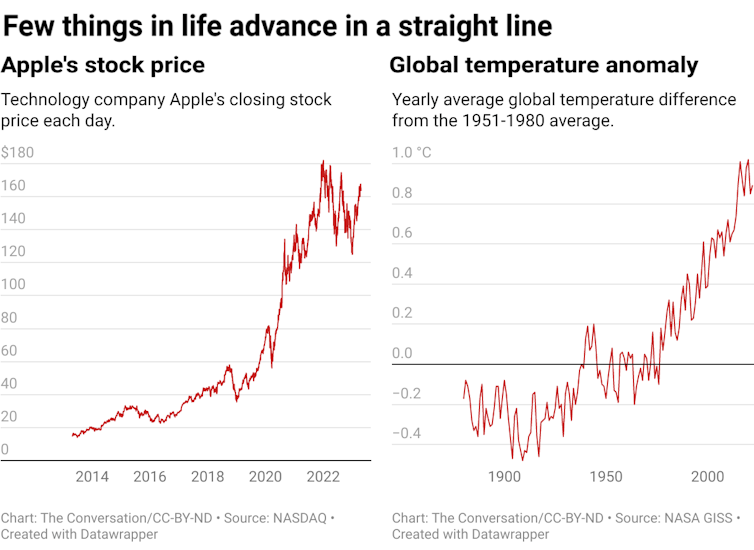

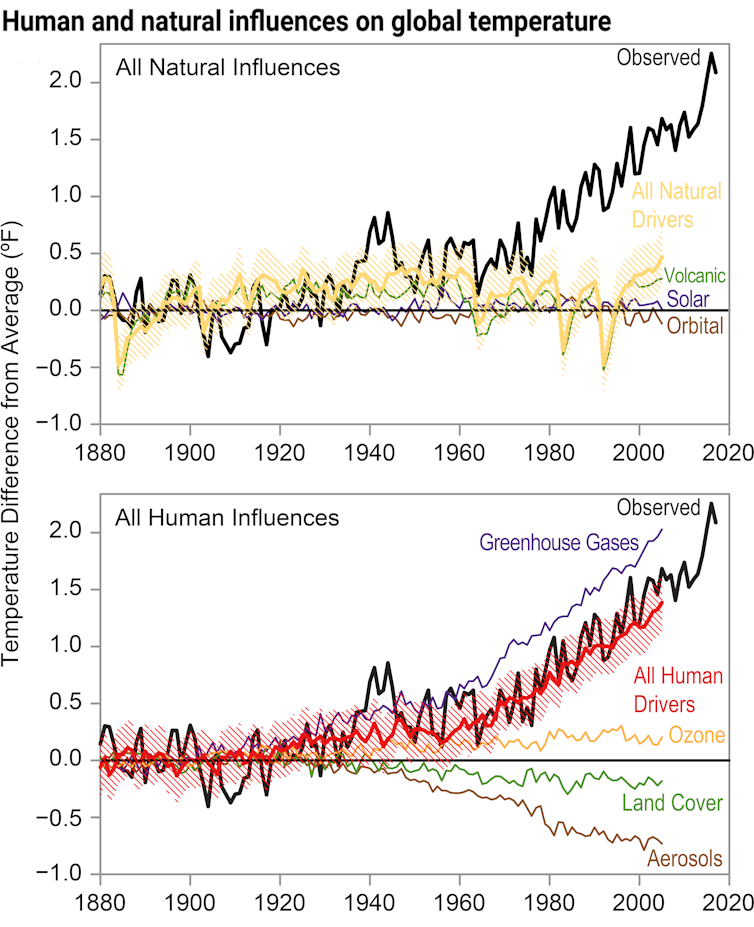

Sustainability has become a popular topic as you hear climate change news daily. Ocean temperatures are rising, leading to melting glaciers and migrating ocean species. Storms have become more volatile, increasing the number of floods and torrential storms worldwide.

Research shows climate change has strengthened hurricanes and raised storm surges due to rising sea levels. In late 2022, you could see the planet’s wrath through Hurricane Ian. The Category 5 storm devastated the Southeast, especially Florida.

Tom Knutson, a senior scientist at the National Oceanic and Atmospheric Administration (NOAA), says rising sea levels exacerbate flooding from hurricanes. The problem will only worsen as rainfall rates rise this century.

Many have experienced the devastating effects, leading to a push for more sustainability efforts. You may have found ways to lower your carbon footprint by reducing your carbon dioxide (CO2) emissions. What about the rest of the country?

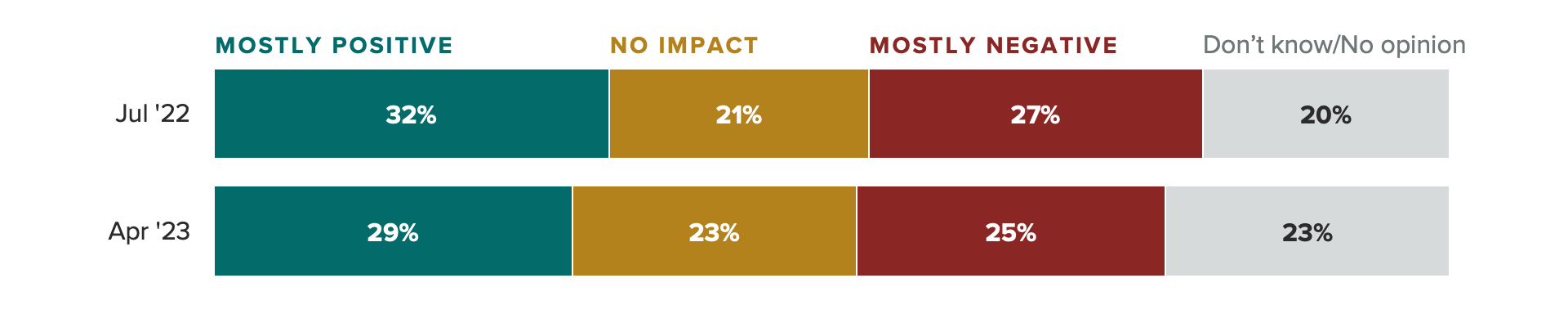

Talking about sustainability efforts is easy — following through with actions is a different story. Many Americans say they incorporate sustainable practices only to impress their friends. Reality shows another picture.

A March 2023 survey finds 53% of Americans exaggerate their sustainable practices. The same poll reveals 54% will revert to unsustainable actions if they’re alone.

Jessica Hann, senior vice president of Avocado Green’s brand marketing and sustainability, says: “When it comes to sustainability, it matters less what people think and more that we all just do the best we can.”

The detrimental impact of greenwashing

Organisations that greenwash mislead customers about the environmental impact of their products and services. They may also use climate-friendly initiatives for PR to cover their environmental malpractice.

A 2023 survey finds more than half of companies admit to greenwashing. Google Cloud and Harris Poll asked executives how they approach sustainability messaging – 59% said they overstate or inaccurately represent sustainable practices.

For the planet’s sake, greenwashing needs to come to an end. Better knowledge and improved technology allow you to be friends with the environment instead of an enemy. These four strategies demonstrate how employers can help themselves and their employees improve their sustainability efforts:

1. Apply for sustainability certifications

A terrific way to prove your sustainability initiatives is to achieve certification. For example, you can receive Leadership in Energy and Environmental Design (LEED) accreditation if your building complies with the requirements. Getting LEED requires passing an examination with the United States Green Building Council.

LEED is one of the most popular accreditation programs, but many others exist. For example, there’s the Sustainable Agriculture Initiative (SAI). This program tracks organisations in the agricultural industry and scores sustainability efforts by awarding bronze, silver or gold status. Achieving SAI’s gold equivalence means your organization has high marks in biodiversity, soil management and greenhouse gas (GHG) emissions.

2. Introduce renewable energy

Buildings have significantly contributed to current climate issues. Data from the International Energy Agency reveals they are responsible for approximately 35% of global energy use. These structures require burning fossil fuels, using steel and cement in construction, and generating electricity and heat. The current blueprint for energy use is less sustainable as demand grows with the world’s population.

One way to reduce your employees’ carbon footprint in the office is to introduce renewable energy. The easiest way to do that is with solar panels. These systems harness the sun’s power and convert it into electricity for your building. You’ll create energy instead of relying on the electrical grid.

Now is an excellent time to buy a solar panel for residential and commercial purposes. The federal government extended the solar tax credit through 2033. Purchasing solar panels allows you to get a 30% rebate on the panels, labour costs and various equipment required for installation.

3. Rethink the supply chain

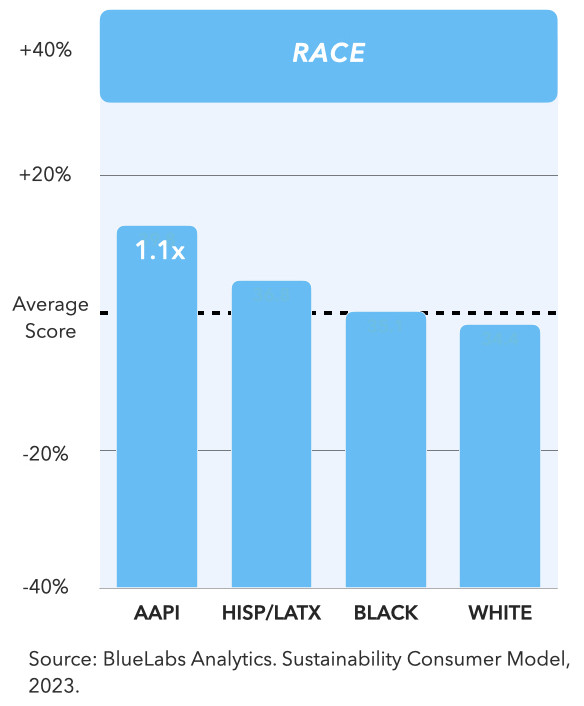

Today’s businesses must be conscious of their environmental impact. It matters for their carbon footprint and environmental, social and governance (ESG) scores. Your ESG rating is vital because it demonstrates your social responsibility to investors and consumers.

One way to improve your ESG scores is to rethink your supply chain and make it more efficient.

For example, consider your suppliers. Are they domestic or international? International partners may have low costs, but the environmental impact is more significant due to the higher demand for fossil fuels.

You can shorten the supply chain by partnering with domestic companies – preferably in your state. These businesses shorten your lead times and reduce your business’s environmental impact.

4. Conserve water

Water is critical in industries like agriculture, construction, fashion and more. Even if you don’t work directly with it, you still need it for bathrooms and water fountains inside the office. The world’s freshwater supply has increasingly become concerning. Cities and states in the Southwest often implement water limits to conserve the resource in the summer.

Your office can become more sustainable by increasing water efficiency. Use low-flow faucets and toilets to minimize use and only consume what’s needed. These systems reduce water usage and lower the money spent on this utility. Nowadays, you can utilize smart technology to monitor use and see where to improve.

Help employees help the planet

Sustainability has become a vital topic of discussion lately. The conversation is necessary as the world faces the wrath of climate change. Most people agree it’s a problem but don’t always take the required actions.

Employees spend a large part of their day in the office, so you should help your colleagues reduce their carbon footprint at work. Incorporate renewable energy and obtain sustainability certifications. These actions demonstrate care for the environment and inspire employees to do more at home.

To see the original post, follow this link: https://sustainabilitymag.com/articles/50-of-american-companies-exaggerate-sustainability-efforts

You must be logged in to post a comment.